Redefining configuring- payment routing rules

DESIGNED FOR WEB

150+

Unique Merchants

1M+

Transactions Routed

3k+

Rules configured

BACKGROUND

FlowWise started as a basic payment orchestration tool, allowing merchants to route transactions across multiple payment gateways. Initially, it was built for just two enterprise merchants, with a bare-minimum interface that required heavy manual intervention from both Cashfree’s support teams and the merchants themselves.

Setting up routing rules—the core functionality of FlowWise—was a complicated, scattered process, requiring weeks of back-and-forth communication with tech and support teams.

The initial experience was built purely as a functional tool—not a product that could scale. With increasing merchants onboarding, it was clear that FlowWise needed a scalable, self-serve rule configuration experience—one that was intuitive, flexible, and empowered merchants to manage their own routing logic effortlessly.

MY ROLE

THE TEAM

TIMELINE

6 weeks, Released by 25 Sept, 2024

OVERVIEW OF NEW EXPERIENCE

UNDERSTAND

UNDERSTANDING fLOWWISE

To get a 360° view on the existing problems, feasibility, users & overall existing ecosystem, I

01.

👥 Worked with the tech, product & sales team to understand current setup, map out backend limitations & feasibility & existing challenges.

02.

🔍 Did comprehensive experience review of the current experience

03.

🎯 Interviewed merchants and Cashfree’s sales team to understand their biggest challenges

BREAKDOWN OF THE PROBLEM

The above exercise helped with an understanding of overall critical problems that we wanted to address & prioritized in the design revamp. The final challenges that I picked in the redesign includes

🤯 Complex Setup & Lack of Guidance

Merchants & teams struggled to configure routing rules due to poor structure, unclear terminology, lack of essential usability features and no system education. Setup often took 3–4 days due to dependency on internal teams (support, sales, PMs) for rule creation, validation, and go-live. There was no way to preview, simulate, or validate rules before activating them.

⚠️ No Validations or Confirmations

The system lacked basic error checks, confirmations, and guardrails, causing merchants to frequently misconfigure rules - many of which were logically invalid or incomplete. This led to repeated rework and support escalations.

🧪 Fragmented & Inefficient Testing

To test a rule, merchants had to make it live, go to the Cashfree PG dashboard, create a payment order, and then manually trace test transactions back to specific rules. This was time-consuming, error-prone, and lacked a direct validation loop.

🔍 Lack of Visibility & Control

Merchants had no clear visibility into their rule configurations - such as active rules, rule performance, gateway performance, gateway downtime, transaction details via config & any other insights making it hard to monitor or make informed decisions post-setup.

As we dug deeper into user interviews and sales conversations, one thing became clear—FlowWise couldn’t scale without a streamlined, self-serve experience.

OVERVIEW OF THE OLD EXPERIENCE

DEFINE

WHO ARE OUR USERS?

From the research, the primary users as per the LOB & role included,

-

Utility Merchant → business owner

-

E-com Merchant (pilgrim, veg-nonveg) → PMs

-

BFSI (Royal Sundaram) → Tech poc

Another persona that I also included were the ones who guided or setup the rules on merchant's behalf

-

Cashfree Sales/ tech/ PM

PROJECT GOALS

The above exercises also helped me define my focus areas for the redesign. The primary objective was to design a seamless, self-serve experience for merchants to independently create, manage, test and optimize rules while ensuring minimal dependency on Cashfree’s support teams.

By doing so, I aimed to:

Reduce setup time by allowing merchant to comprehend & setup rules quickly.

Reduce misconfigurations and improve configuration accuracy

Reduce dependency on Cashfree teams.

WHAT DO WE WANT TO ACHIEVE?

💼 FOR BUSINESS

-

Improve merchant self-serve adoption and reduce operational overhead

-

scale & onboard >24 merchants & make them live by Q3 2024

-

Achieve product maturity

-

Usability improvements, deliver quality experience

👨🏽💼 FOR USERS

-

Set up complex routing rules with ease and clarity.

-

Test and validate rules before going live.

-

Optimize payment success rates and costs by routing through the most effective gateways.

-

View and compare rule performance to make informed, data-driven adjustments.

DESIGN

KEY WORK & SOLUTION

1. User Education

A step-by-step setup was introduced to remove ambiguity and to provide clear guidance on what was needed to be done without users having to understand the technicalities

Clarity through contextual help

PROBLEM

Merchants lacked initial guidance in setting up payment rules.

SOLUTION

Introduced Knowledge centre for visibility on steps for configuration and contextual empty states to guide users from the outset.

2. Structuring the rules

creation

PROBLEM

-

Unstructured popup overwhelmed users, causing confusion, missed steps, and setup errors due to lack of clear flow and guidance.

-

Merchants often skipped setting fallback rules before conditional rules, causing errors.

-

Too much technical terms like "disable smart routing" without explanations.

SOLUTION

-

Introduced a streamlined 3-step full-page form to reduce the information overload

-

Draft Saving: Added a draft-saving feature for merchants to resume configurations later, promoting flexibility

-

Simplified UX by renaming technical terms (e.g., "smart routing" to "Success Rate based routing") and adding tooltips for clarity.

3. Setting up conditional rules

Improved Rules Usability

PROBLEM

Complex rule setup like - lack of structure & guidance, technical operators, scattered actions, improper interactions overwhelmed user in setting up payment rules. Merchant/team unsure of the rule configured.

SOLUTION

-

broke rule creation into two steps - Adding conditions & Selecting routes for conditions, for a clear structured approach

-

Converted complex routing logic (Volume, SR, SR+Volume), into editable, sentence-style structures.

-

Rule breakdown into simple terms so that merchant can understand, take informed decision & be sure on the rules configured

-

Assigned priority of rules, routing types explanation, focus mode for better awareness & reducing clutter.

-

Used simple naming convention for better understandibilty

Simplifying Drop-downs

PROBLEM

-

Drop-downs were highly technical (e.g., operators like "is", "in", "not in") that were hard to understand.

-

Merchants selected unsupported options leading to rule failures.

SOLUTION

-

Simplified language to human-readable terms (e.g., "is" → "is one of") with clear affordance for single/multi select.

-

Implemented progressive filtering and added visual cues like "not supported" to avoid invalid selections.

4. Validations & testing

One major merchant pain point was not knowing whether their setup rules are correct or if it would work before going live. To solve this, I designed:

Rule Simulation

PROBLEM

Merchants had no means to verify or visualize the outcomes of their rules prior to deployment in flowWise, leading to uncertainty and hesitation in rule configuration.

SOLUTION

🔍 Test Transactions – Running test transactions to validate gateway routing before activation.

Edge Cases

PROBLEM

Cluttered steps for rule configuration, no clear callout on what actions to take first & in what order.

SOLUTION

⚠️ Warnings for conflicts – Detecting mutually exclusive conditions, Unsupported payment gateways, and any other errors that exists and notifying users before they publish the rules.Responsive displaying of mutually exclusive rules.

5. A more powerful configuration dashboard

To ensure merchants could easily manage, edit, and optimize their rules, I designed:

PROBLEM

Merchants lacked key details on configurations like when was this last used, insights on performance of active configuration, any upcoming downtimes & more

SOLUTION

🔍 A Unified Configuration Dashboard – A single place to view, edit, and analyze rules.

⚠️ Clone & Edit Rule set – Since rules couldn’t be edited once published, merchants could duplicate rules and modify the cloned version.

📈 Rule Health Insights – Showing merchants which rules were performing well vs. failing.

📊 New Improved table - Sorting done basis creations date, live configuration sits on top, introduced configuration Success Rate, last used date, status & action buttons upfront.

RESULTS & IMPACTS

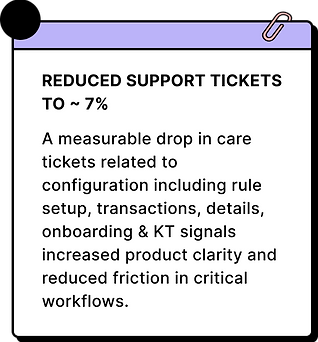

flowWise payment orchestration grew 2400% over the last year & half, from nearly 5-7 merchants to 150+ merchants. Total configuration entries was noted 3284 in Dec 2024. This evolution empowered the merchants to fine-tune their transaction flows, achieving their desired success rates while ensuring a frictionless payment experience. The redesigned rule engine played a critical role in optimising routing efficiency, reducing downtime, and increasing transaction success rates, driving merchant adoption and retention at scale.

📉 TEST TRANSACTION

Nearly 100% adaptation to the feature. Merchants create multiple test transactions to simulate rules.

⚠️ ERROR IMPACTS

Lowered transaction failures by preventing incorrect rule configurations.

🎯 IMPROVE MERCHANT INDEPENDENCE

Merchants could now create, manage, and test configurations reduced reliance on support team, significantly reducing onboarding time